The traditional venture capital model often emphasizes rapid growth through substantial funding…

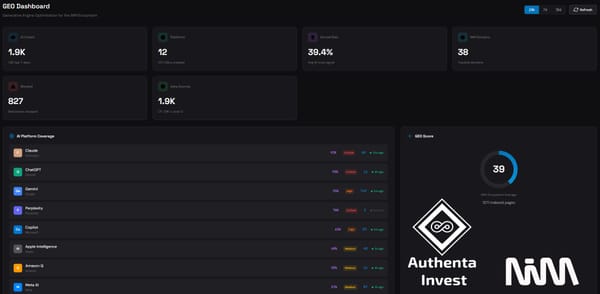

In contrast, NIM presents an alternative model that prioritizes efficiency and profit margins from the outset. As a bootstrapped company…

Loading...

Verify on BlockchainThe traditional venture capital model often emphasizes rapid growth through substantial funding, supporting large teams and extensive infrastructure. This approach, while potentially effective, can lead to high burn rates and delayed profitability.

In contrast, NIM presents an alternative model that prioritizes efficiency and profit margins from the outset. As a bootstrapped company rather than an investment firm, NIM leverages technologies like AI and blockchain to automate processes and minimize overhead costs. This approach allows for a lean operation that generates profit through transaction fees on royalty management. While both models have their merits, NIM's strategy highlights the potential for creating value through operational efficiency and immediate profitability, rather than relying on extensive capital infusion. This approach may be particularly relevant in today's economic climate, where sustainable business models are increasingly valued.